osceola county property tax calculator

The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and. Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744.

Ad Get In-Depth Property Tax Data In Minutes.

. 2505 East Irlo Bronson Memorial Hwy. Scarborough CFA CCF MCF Osceola County Property Appraiser Tax Estimator. Please fill in at least one field.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523. Such As Deeds Liens Property Tax More.

Kissimmee Florida 34744. BSA Software provides BSA Online as a way for municipalities to display. The Tax Collectors Office provides the following services.

Search Valuable Data On A Property. This is equal to the median property tax paid as a percentage of the median home value in your county. Reed City MI 49677.

Pay property taxes tangible taxes or renew your business Tax. We use a Market Value range of 875 to 1125 of the purchase price you enter. To begin please enter the appropriate information in one of the searches below.

Osceola County collects on average 095 of a propertys assessed fair market value as property tax. The estimated tax range reflects the lowest to highest total millages for the taxing authority selected. Start Your Homeowner Search Today.

It also applies to structural additions to mobile homes. Current tax represents the amount the present owner pays including exemptions. This property is fully exempted from paying taxes.

Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. If purchasing new property within Florida taxes are estimated using a 20 mill tax rate. Florida Property Tax Calculator.

Osceola County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. In seconds our Osceola County Florida Mortgage Calculator will have an estimate of your monthly payment. Thank you for your patience while we upgrade our system.

Federal Tax Forms Publications. Get driving directions to this office. Search all services we offer.

407-742-3995 Driver License Tag FAX. 2505 E Irlo Bronson Memorial Highway. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill.

OSCEOLA COUNTY TAX COLLECTOR. Osceola County Florida Property Search. Ad Enter Any Address Receive a Comprehensive Property Report.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. 407-742-3500 Send Feedback Hours. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

This service allows you to search for a specific record within the Delinquent Property database to make a payment on. 8am - 5pm Monday through Friday excluding holidays if you are making a payment you must receive a wait number by 430pm The Recording Department stops recording promptly at 430PM. For more information go to the Tax RollMillages link on the homepage.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Osceola County. See Results in Minutes. Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property.

Find All The Record Information You Need Here. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes. OSCEOLA COUNTY TAX COLLECTOR.

Internal Revenue Service IRS Wisconsin Department of Revenue. The County Treasurer is the custodian of the Countys money. Learn all about Osceola County real estate tax.

407 742 5000 Phone 407 742 4900 Fax The Osceola County Tax Assessors Office is located in Kissimmee Florida. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan. Osceola Tax Collector Website.

If you are considering becoming a resident or only planning to invest in the countys real estate youll come to know whether Osceola County property tax regulations are helpful for you or youd rather look for another location. Each receive funding partly through these taxes. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value.

Welcome to the Delinquent Property Online Payment Service. Use this Osceola County Florida Mortgage Calculator to estimate your monthly mortgage payment including taxes and insurance. Osceola County Courthouse 2 Courthouse Square Kissimmee Florida 34741 Contact Information.

Begin Estimating Property Taxes. Florida Statutes 201 20102 20108 ON OBLIGATIONS TO PAY MONEY MORTGAGES 035 per 100 or fraction thereof Tax due on total amount of indebtedness as shown on document Due and payable when the instrument is presented for recordation ADDITIONAL INFORMATION ON. In our calculator we take your home value and multiply that by your countys effective property tax rate.

INFORMATION ON DOCUMENTARY STAMP TAX Reference. Osceola County Property Appraiser. Dont have a driver license.

Irlo Bronson Memorial Hwy. Osceola Real Estate Personal Property Tax Information. These are deducted from the assessed value to give the propertys taxable value.

Learn how Osceola County levies its real property taxes with our detailed review. Visit their website for more information. Actual property tax assessments depend on a number of variables.

Treasurers Office responsibilities include. The information provided above regarding approximate. Unsure Of The Value Of Your Property.

Enter your Home Price and Down Payment in the fields below. Irlo Bronson Memorial Hwy. Osceola County Courthouse 2 Courthouse Square Kissimmee Florida 34741 Contact Information.

The median property tax on a 19920000 house is 209160 in the United States. Osceola County Florida Property Search.

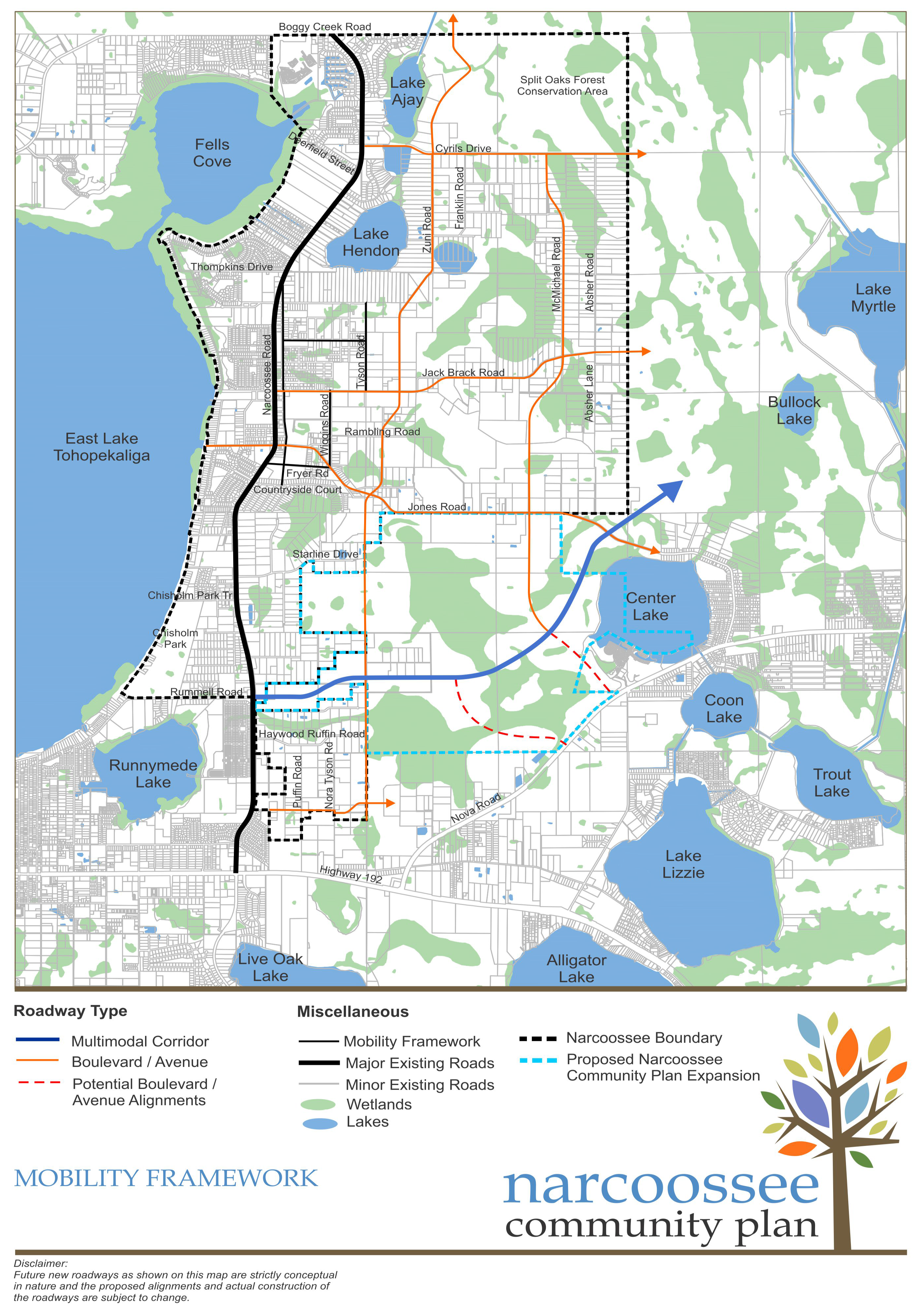

Chapter 4 Site Design And Development Standards Land Development Code Osceola County Fl Municode Library

How To Pay Osceola County Tourist Tax For Vacation Rentals

Osceola County Clerk Of The Circuit Court

Osceola County Proposes Flat Property Tax Rate Orlando Sentinel

Focus Parent Portal Letter School District Of Osceola County

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Lake Garden Celebration Fl

Osceola County Property Appraiser How To Check Your Property S Value

2022 Best Places To Raise A Family In Osceola County Fl Niche

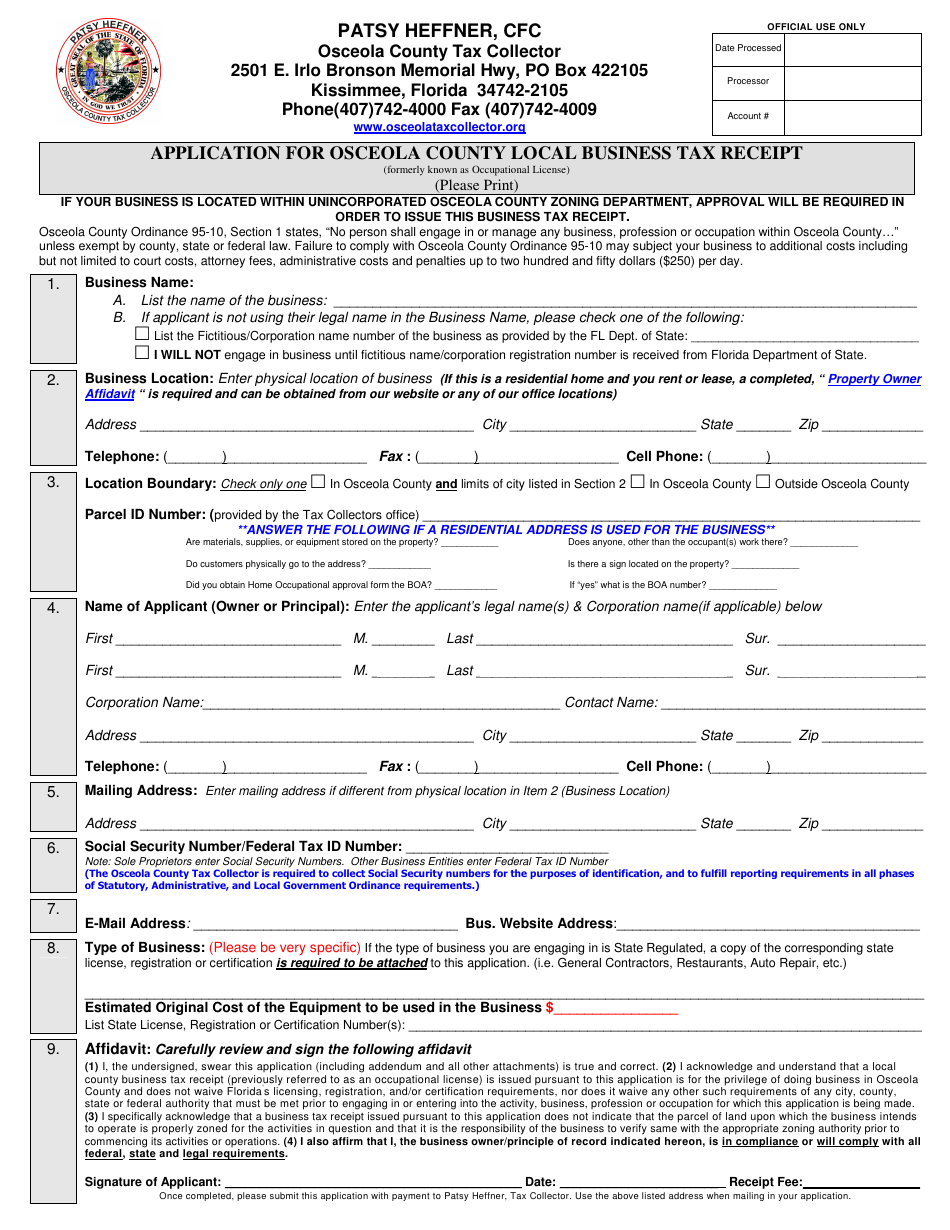

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

How To Pay Osceola County Tourist Tax For Vacation Rentals

Curriculum Amp Instruction Consent Agenda Osceola County School

Osceola County Property Appraiser How To Check Your Property S Value

Property Tax Search Taxsys Osceola County Tax Collector

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller